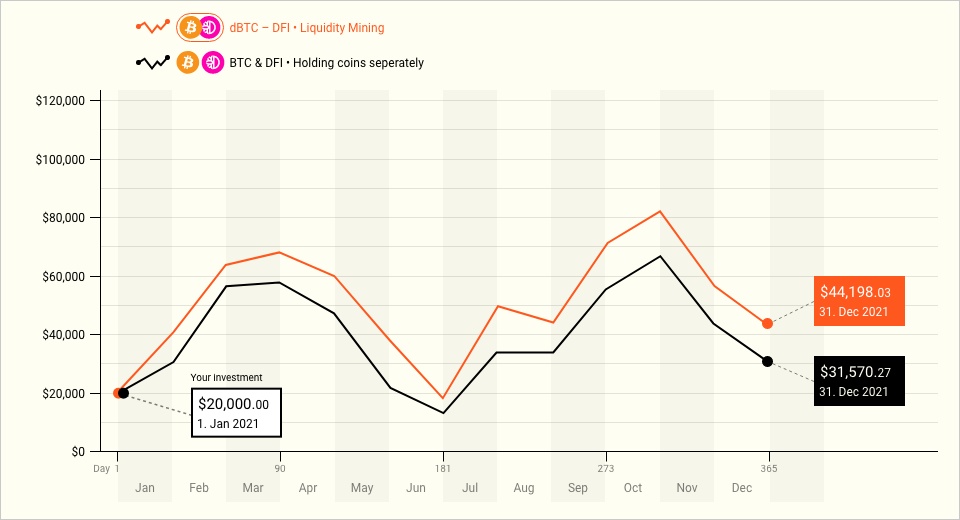

Experience the CRYWIN-Effect in Liquidity Mining: Amplify your gains and mitigate potential losses in the world of Decentralized Finance (DeFi). By participating in liquidity pools and earning interest on your contributed tokens, you can offset losses during market downturns. Furthermore, as token prices surge, your potential profits skyrocket alongside the increased value of the earned interest. Unleash the power of the CRYWIN-Effect and maximize your rewards in Liquidity Mining! Let's delve into a concrete example to illustrate the impact of the CRYWIN-Effect in a Bitcoin liquidity pool. Suppose you invested $20,000 in a Bitcoin liquidity pool from January 2021 to December 2021. In that time period, not only would you benefit from the appreciation of Bitcoin's value, but you would also earn an additional $12,600 in interest. Without liquidity mining, your potential gains would have been significantly lower.

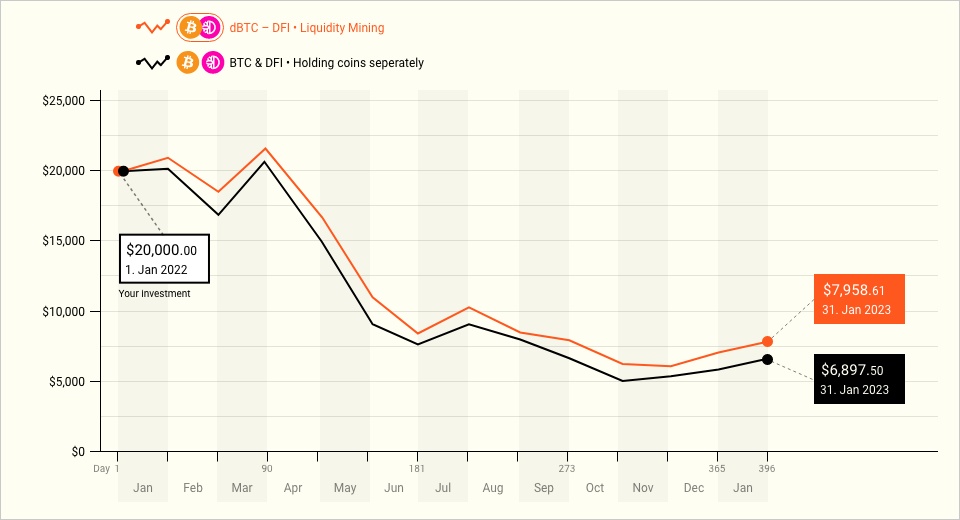

During a market downturn, such as the period between January 2022 and January 2023, you might have experienced a loss of $12,000 when investing $20,000. However, through liquidity mining, you would have earned $1,000 in interest, effectively reducing a significant portion of the loss.

It's not hard to understand that investing in liquidity mining instead of just holding cryptocurrencies is a simple but very effective way to get more returns.

Crywin boosts your profits and cushions your losses.

How can we help you?

Write us

Call us Mon-Fri 8-17 CET

0800 0001 123

About us

Our motivation